Confuse to Choose Between Chapter 7 or Chapter 13 – Which One Better for Your Condition

Difference between Chapter 7 and chapter 13 bankruptcy Tampa. How do you know which chapter of bankruptcy is good for you?

For most individuals, there will not be an option, They will qualify for which type of bankruptcy is the good option for them. a rational choice for them & proceed with some to no option in the case. Every individual filing is subject to a medium test that evaluates property or assets, loans, and other financial criteria. And for any individual, the best option is apparent.

But what if you fall into the cluster of filers who do have a choice?

Is the right option is good than the other? And what if things alternate at a few points & your prime choice is no longer the better option?

Here’s is some point when you choose between chapter 7 & chapter 13 & what you need to know about.

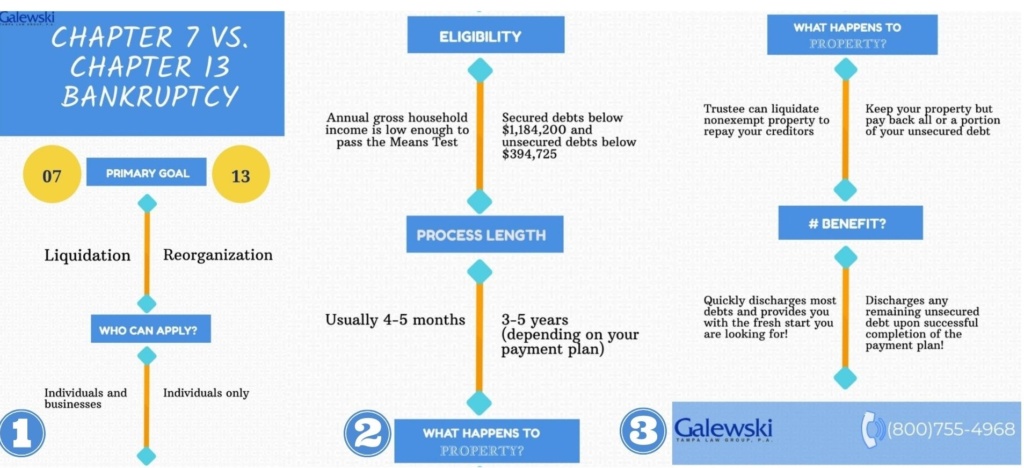

Chapter 13 vs. Chapter 7

Chapter 13 bankruptcy filing assents you to liberation a wider range of debts than Chapter 7. The who person fills Chapter 13 bankruptcy has a long time period of protection under the automatic stay. And lots of cases, Chapter 13 also permits you to retain proprietorship of more of your assets than Chapter 7. But this doesn’t mean Chapter 13 is always good than Chapter 7.

Chapter 13 needs you to create payments on your debts for a long time period, maybe three to five years. It’s called “wage earners’ bankruptcy” for this factor. You are not free and clear of your loans for a long time in chapter 13 and if you have no job or other income source. You are not eligible for Chapter 13 bankruptcy filing.

But in some exceptional cases, a person will be eligible for both types of bankruptcy & need to make a decision. It may seem as if Chapter 13 is the main choice. Because you need more protection & are permitted to hold more assets, in exchange for repayment you can afford.

This is not always the case.

Someone who knows his or her income will increase over the next 3 to 5 years, would likely be well served by filing for Chapter 7.

One of the major advantages of Chapter 13 is that in the future something changes during your repayment time period. You also can the some change the amount of your monthly payment. If you have decreased income or you lost your job, The court might be asked to decrease your payments. It is even potential in harsh circumstances to alter your Chapter 13 case to Chapter 7.

Chapter 13 Requires a Long-term Commitment

But the opposite is also a reality. If you view an enhancement in income during that repayment period. The trustee might ask the court to changes to your payments to reflect this increase. You had to be earning more money yet a lot of enhancement would go to loaners. now those in Chapter 7 the enhancement would be a moot point since your case would be closed. You had been able to pay more towards the loans you still be in debt that were not clear in chapter 7, but the circumstance should be under your control. You had been choosing to pay creditors more, not the trustee.

Chapter 7 is about the here and now the last judgment by the court depends on your present situation. Under Chapter 13, the court estimates your present situation. yet the court also sees the future evolution. you are creating a multi-year commitment to having your economic circumstance exposed to the court, If you handsomely expect your economic circumstance will significantly improve during that time, you may want to think two times about filing for Chapter 13.

If you are not clear which chapter of Bankruptcy (chapter 7 or chapter 13 bankruptcy Tampa ) is better for you or you need help evaluating your financial prospect in the near future, We can assist. Contact the Galewski Law Group, P.A. of Stanley J. Galewski at (800)755-4968 to discuss your situation.

Also Read This Article: