Bankruptcy stage is always a painful experience for a businessman in its business. It is a bad situation for the owner as well as its business partners. To overcome the situation, you can take business loans and include the co-signers to repay the loan amount with mutual efforts. Hence, you can share the liability of paying a loan to the bank or creditor. So, the borrower has a sign of relief from the cosigner to complete the fund on time. But, in case, of paying loan gets stopped from end of the borrower then the cosigner has to pay the remaining or full amount.

What happens, when any one of the business partners files the business bankruptcy? Will it affect the credit of the borrower and cosigner too? Well, it does, if the business leads to bankruptcy stage and the borrower is not in the condition to repay the loan amount. The cosigner has to suffer and its credit will also harm.

In case, a cosigner wants to show his credit report after the bankruptcy of business, he or she has to show details of the last loan payment. The cosigner can take complete details of loans from banks or financial authorities and submit them to the credit bureaus. All in all, a cosigner needs to follow the legal steps to improve its credit score after bankruptcy. To manage all the legal processes of bankruptcy and credit score works, you need to hire an experienced bankruptcy lawyer. For instance, you can take the aid of a Tampa bankruptcy lawyer service firm named “Galewski Law Group”. This is a law group firm, located in Tampa, FL. At this law company, you will get complete ranges of business bankruptcy and case filing solutions from expert bankruptcy attorneys in the city.

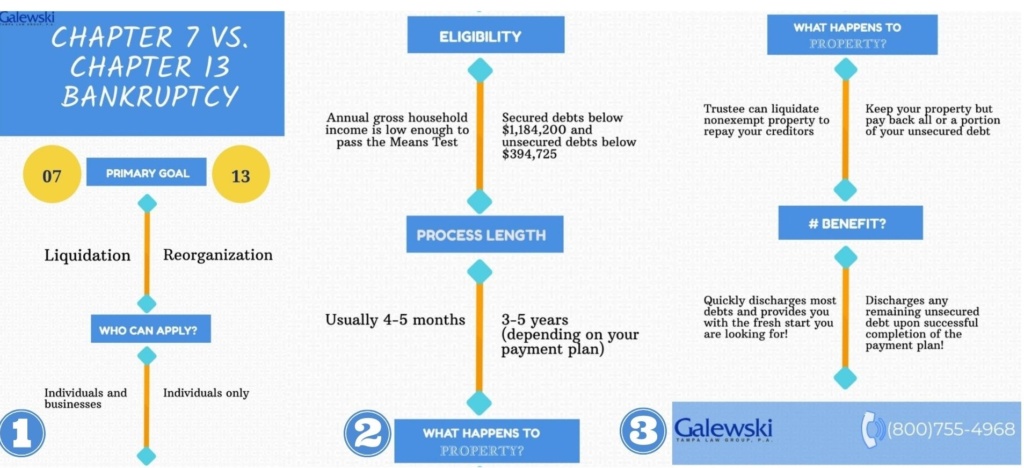

A cosigner has to suffer if a borrower does not pay the loan amount. Hence, it can affect to co-signer’s credit that woo it file for bankruptcy too. In this situation, the cosigner should consult an expert bankruptcy attorney in Tampa, FL. The lawyers at the “Galewski Law Group”, will guide you right ways to get out of the situation and file for Chapter 7 and 13 bankruptcy through legal steps. Moreover, the bankruptcy lawyers at the company will help you file the case and will handle all documentation procedures too.

Filing bankruptcy Chapter 7 and Chapter 13 by the borrower or cosigner will not give permanent relief from repaying the loan amount. It will allow them to stop collecting amounts from debtors till the case is in court. It will give relief to the co-signers to get an automatic stay on collection from the creditor for some time, after tiling the Chapter 13 bankruptcy case. Hence, it will give time to the cosigner to improve its credit and collect money to repay the whole amount to the creditor. To know more about Chapter 7 and 13 bankruptcy law, you can consult the reputed bankruptcy attorney in Tampa, FL, or approach the Galewski law firm.

Also Read: 5 Things You Need To Know About Bankruptcy And Divorce

Here are some legal things that can apply by a co-signer to protect its credits by filing bankruptcy:

1. The cosigner can lift the stay by obtaining a permission letter from the court through the legal process.

2. In case, the creditor likes the co-signer’s repayment plan to complete the debt amount. The creditor can issue a consent letter signed by the court and him to lift the stay.

3. Follow all legal norms of Chapter 13 to enforce the stay on the collection.

4. Appeal the creditor for giving relief to repay some types of debts like medical bills, personal loans, credit card bills, etc. Thus, it will make it quite easy for borrow and co-signers to repay funds as soon as possible.

Thus, above are some right ideas that can help a co-signer or borrower to protect their credits through legal ways. For more help, you can consult the Tampa bankruptcy lawyers at Galewski Law Group, the law firm in Florida. For more details, visit https://galewski.com/

5. Does Bankruptcy Help in Your Child Custody?

5. Does Bankruptcy Help in Your Child Custody?